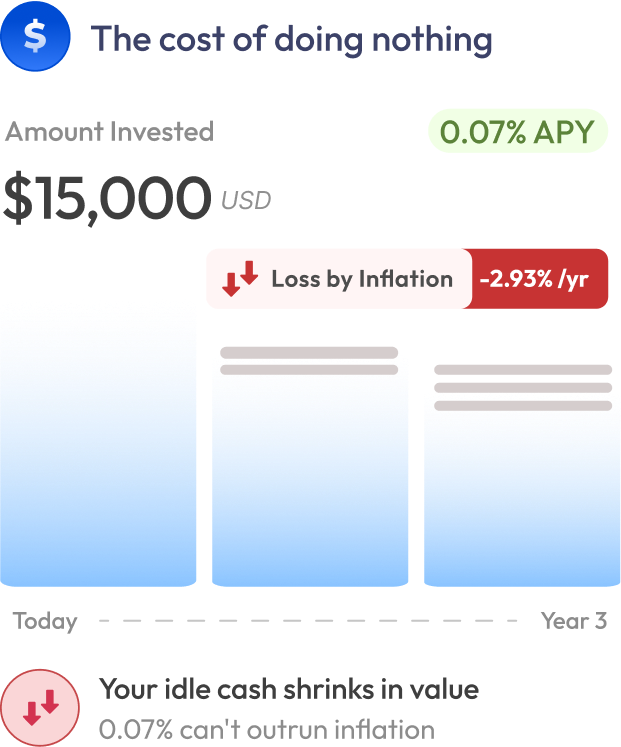

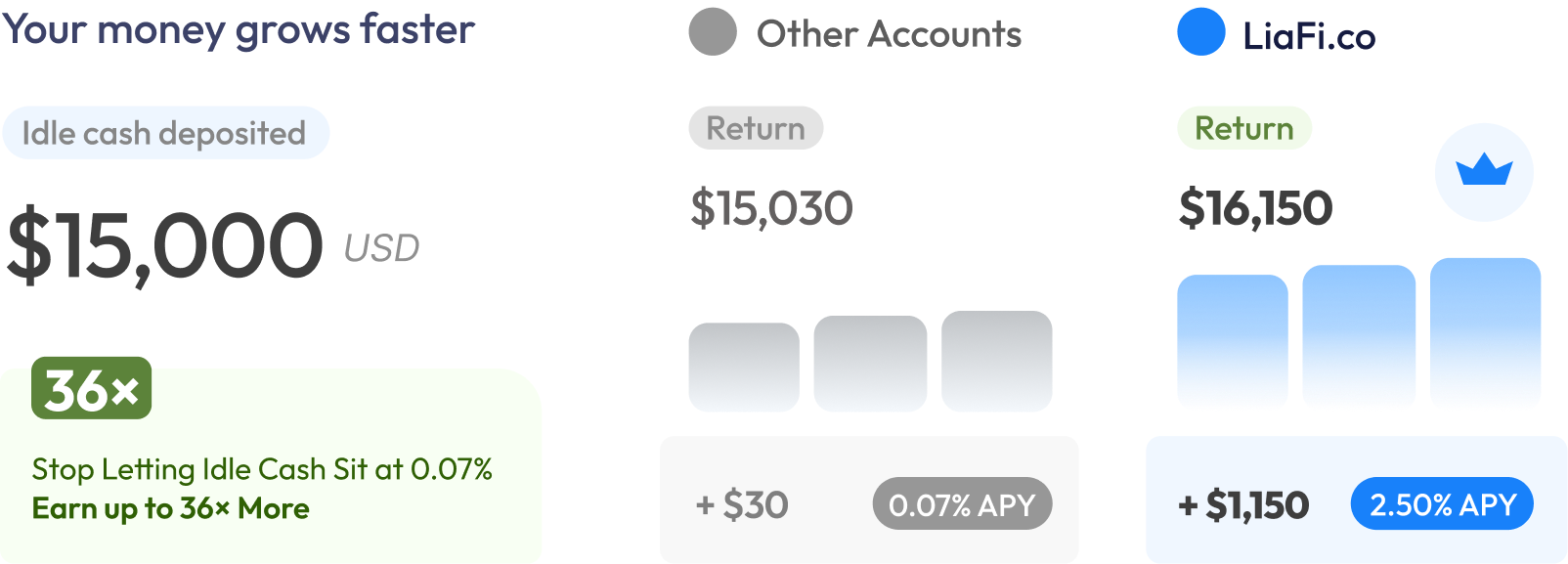

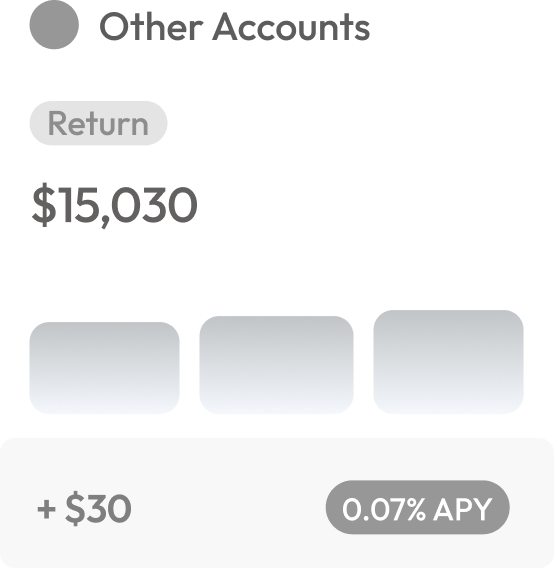

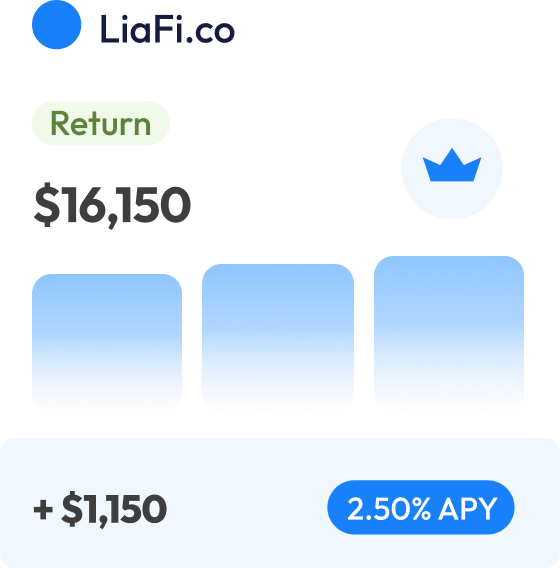

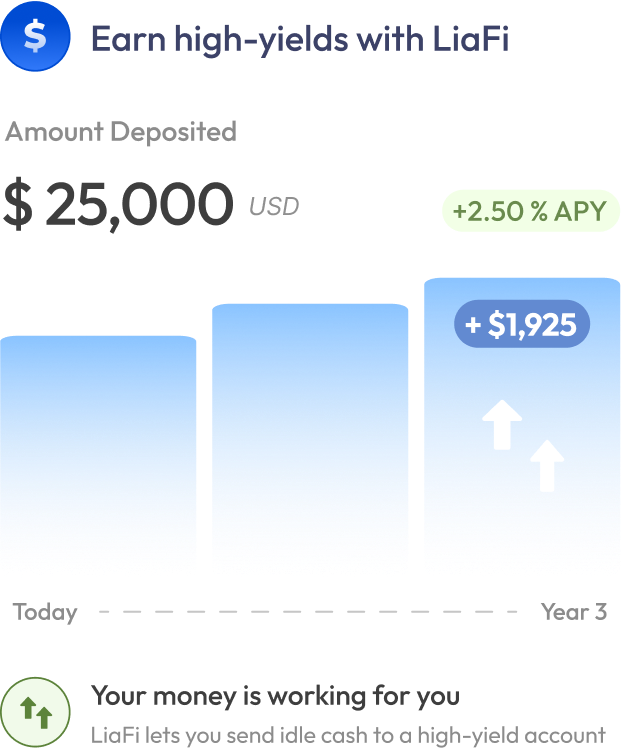

You didn’t know you could earn more

Most small business owners don’t realize they can earn meaningful interest on everyday balances. Many assume a savings account is the only option, when in reality there are smarter, more flexible ways to put your money to work.